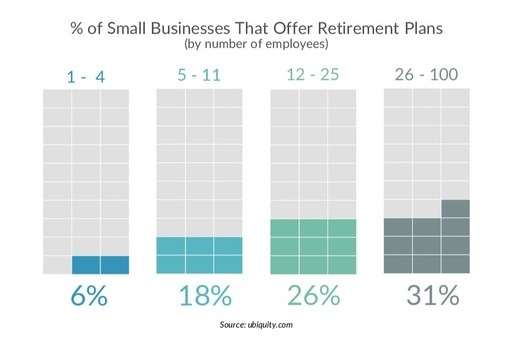

Small- and medium-size businesses (1 – 100 employees) face unique challenges with retirement plans. Those challenges usually result in one of two scenarios. Either you have no retirement plan in place for your employees, or the plan you do offer is woefully inadequate for your business’s needs.

If you choose not to offer a retirement plan, you, your employees and your business can be adversely impacted. If you do offer a plan, you can face an onslaught of financial, administrative and regulatory hurdles, not to mention dealing with unhappy employees. Whether you have one employee or 100, the challenges don’t change, just the number of people impacted by them.

Need help with an existing company retirement plan?

Fees too high?

Investment options lacking?

No Roth savings option?

No communication from the advisor?

Too few participants?

Enrollment meetings offer no value?

Constantly fielding questions from employees?

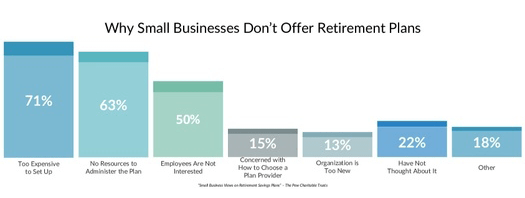

Need help setting up a company retirement plan?

Worried about cost to set up?

Worried about the cost of employer contributions?

Don’t know where to start or who to call?

Employees don’t seem interested?

No time to research and learn?